Generative AI is a game-changer with applications across industries. Companies are actively discussing it, venture capitalists are heavily investing, and both employees and users are captivated, making it a focal point of attention.

On one side, there are optimists who believe GenAI will be as revolutionary as the internet, while on the other, pessimists argue that it’s “just another fad” with no tangible value. Pragmatists are beginning to question whether the GenAI hype is fading. This piece aims to explore these perspectives.

GenAI: a market on the rise

Generative AI has rapidly evolved from experimental technology to a critical asset for businesses across various sectors. According to a Bloomberg Intelligence report, the global GenAI market was valued at approximately USD 40 billion in 2023, representing a tenfold increase since 2020. It is projected to grow into a USD1.3 trillion market by 2032, with an anticipated annual growth rate of 42%. Similarly, Fortune Business Insights estimates that the global GenAI market will reach ~USD 1 trillion by 2032, growing at an annual rate of 40% from its current value of ~USD 43 billion.

NVIDIA and Open AI, often considered the poster children of AI- NVIDIA with its computing chips and Open AI with its AI models and solutions, have seen their valuations surge. NVIDIA was valued at ~USD 400 billion in June 2022, ~USD 1 trillion in June 2023, and ~3 trillion in June 2024. OpenAI, meanwhile, has more than quadrupled its valuation to ~USD 157 billion in its latest funding round, up from USD 29 billion in 2023. The investors backing these companies include not only VCs but also major industry players like Microsoft and NVIDIA.

These valuations highlight the rapid rise in confidence around GenAI, with stakeholders eager to claim a share of what could become a multi-trillion-dollar industry in the medium term. GenAI has been labeled as the “next big thing post-Internet”.

Is this a mere “hype”?

Is GenAI a mere euphoric “hype”? Since the dot-com bubble burst in 2000s, investors in emerging technologies have approached with caution—and rightly so, given that most such technologies have not stood the test of time. With that in mind, is the current enthusiasm surrounding GenAI simply another “hype,” or is there real “substance” behind its rapid growth?

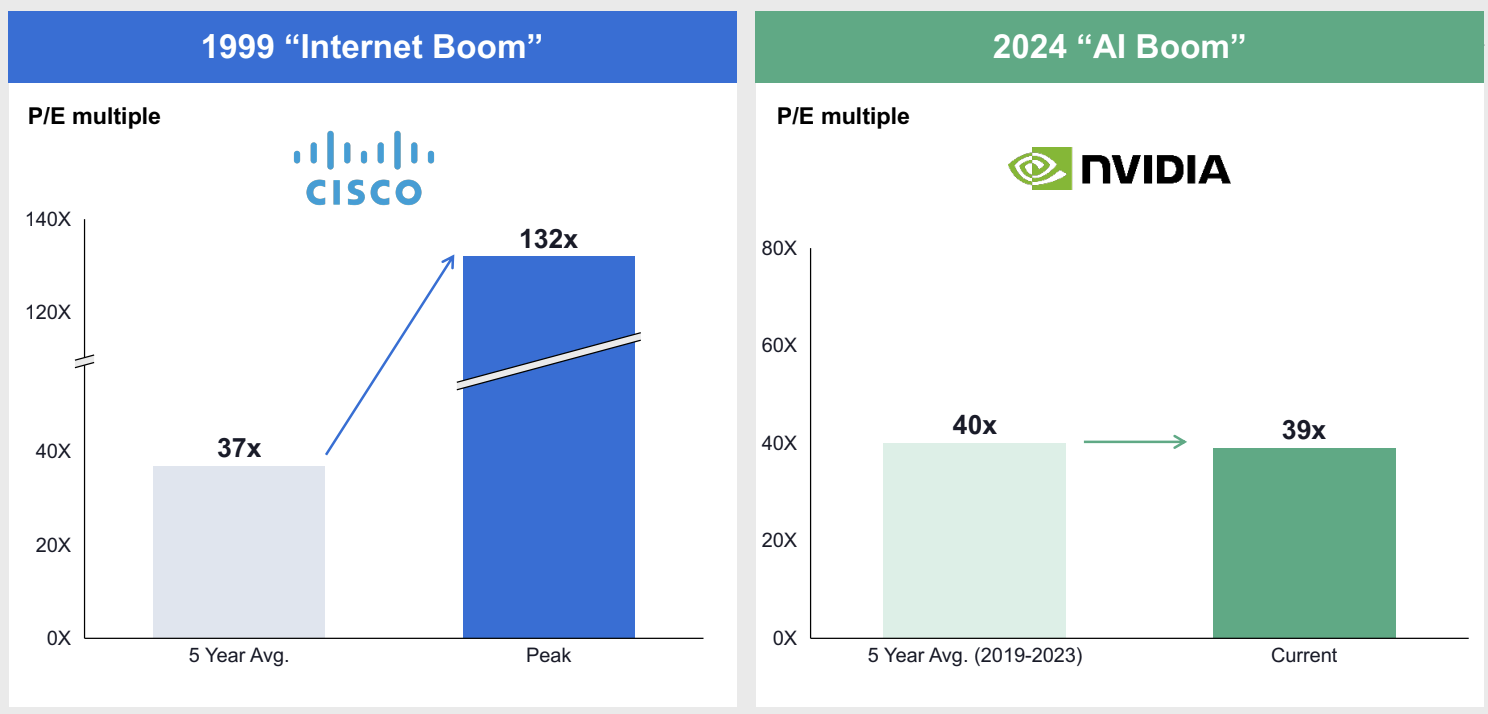

To explore this, we can look at NVIDIA’s stock, one of the poster children of AI with its computing chips, and compare it to CISCO’s valuation during the Internet bubble of the early 2000s.

Figure 1: Forward P/E Multiple of Cisco (Left, during dot-com bubble) and NVIDIA (right, End of June 2024)

The comparison above suggests that AI is not a bubble; it does have substance behind its growth, unlike the dot-com bubble of 2000s: Cisco’s rise in the late 1990s and early 2000s rise was driven primarily by multiple expansion, whereas NVIDIA’s growth is fueled by strong increase in revenues and earnings, rather than a rise in valuation multiples driven by irrational euphoria.

Not too long ago, in 2007, Apple surprised Wall Street following the launch of the iPhone. Its earnings grew while its forward P/E ratio remained flat. Today, Apple is the most valuable company in the world. This serves as further evidence that there is real merit behind steep growth, and it underscores the substance supporting AI’s potential.

Moreover, in the history of technology (although short), there has never been a technology in which all of the top 7-8 tech companies, including the FAANGs included, have invested millions of dollars, except for GenAI!

Is the hype “dying”?

Now that we’ve established that Generative AI isn’t just “hype,” let’s address the “dying” part.

This is a classic case of Perception vs Reality!

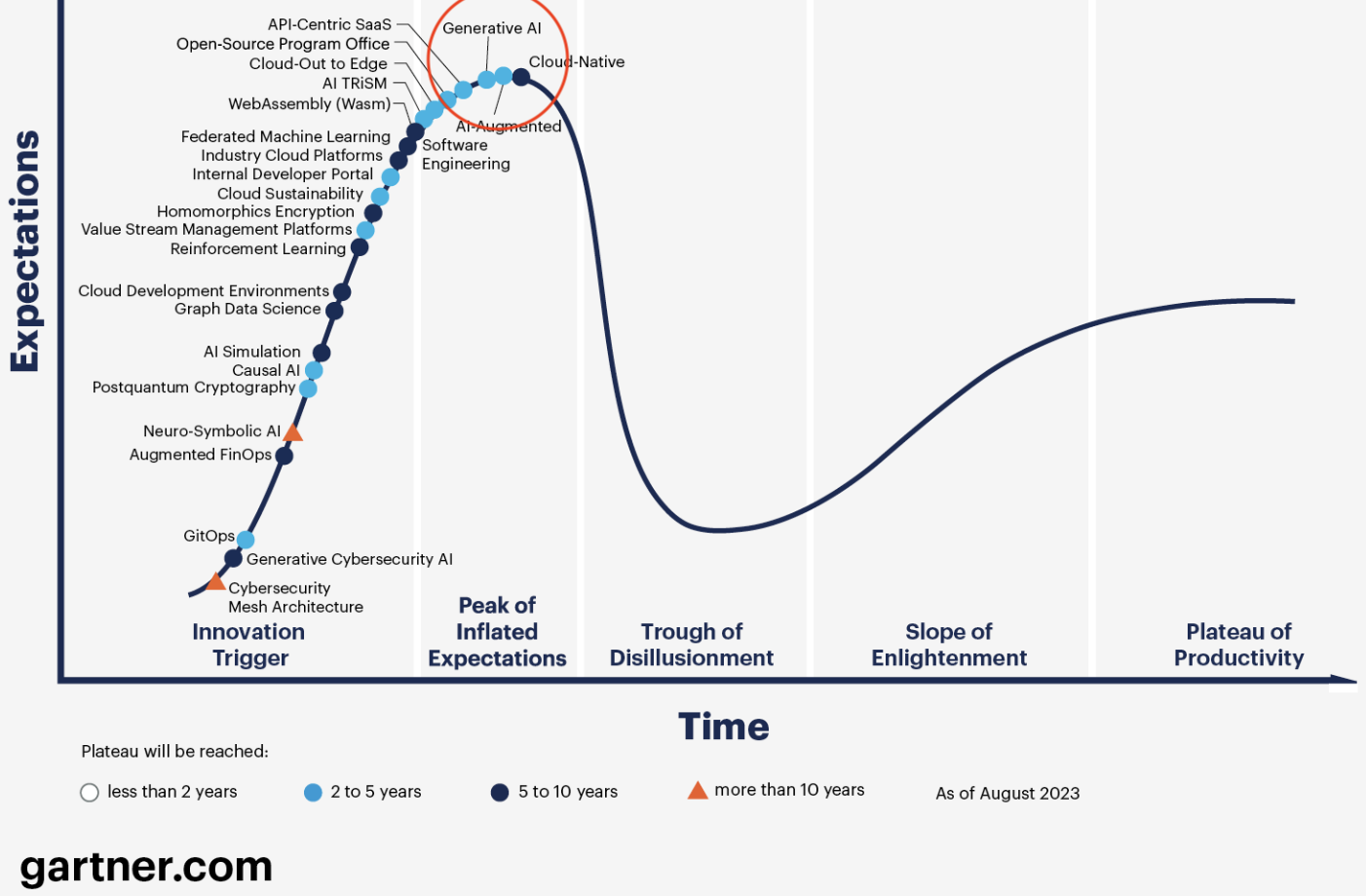

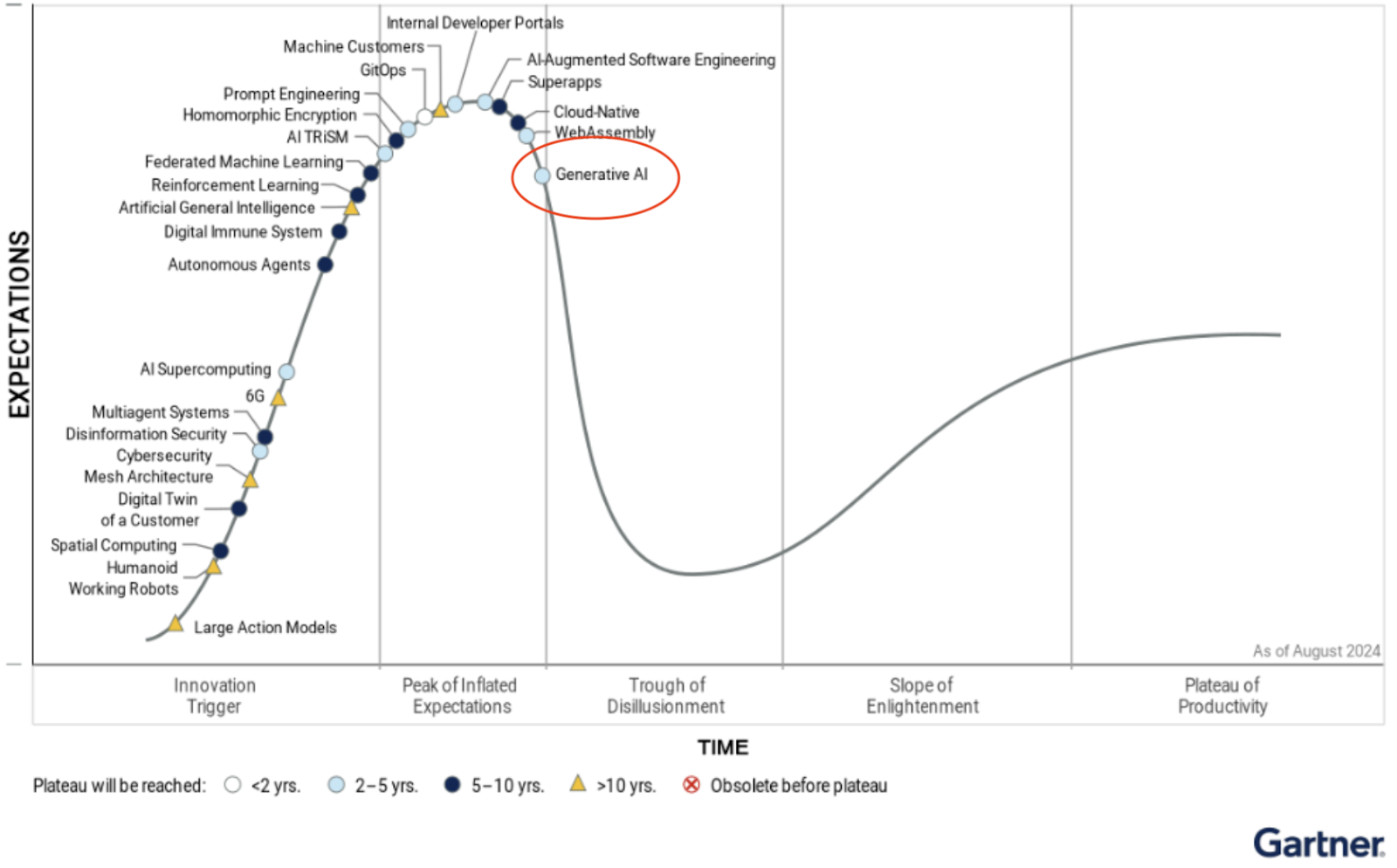

Some reports suggest there is a period of waning interest in GenAI following the initial enthusiasm. Gartner tracks the evolution of emerging technologies across their life cycle in its renowned “Hype Cycle for Emerging Technologies”, which serves as a respected benchmark for measuring the hype around new technologies. Over the past 20 years, more than 200 unique technologies have been featured in this analysis. According to the Hype Cycle, technologies typically follow a maturity curve, passing through five stages: Innovation Trigger, Peak of Inflated Expectations, Trough of Disillusionment, Slope of Enlightenment, and Plateau of Productivity.

The 2024 report indicates that GenAI is likely to entering, or may have already entered, the “Trough of Disillusionment” phase. This phase is characterized by a waning of Interest as experiments and implementations fail to meet expectations. During this stage, producers of the technology may struggle or fail, and investments continue only if the surviving providers can improve their products to the satisfaction of early adopters.

However, data shows that interest and adoption of GenAI remain robust. According to a McKinsey survey, 65% of respondents report that their organizations are regularly using GenAI, nearly double the percentage from the same survey last year.

AI adoption by respondents’ organizations had hovered around 50% in recent years, but it has now increased to 72% in 2024.

This adoption trend is global. In 2023, the survey found that AI adoption had not yet reached 66% in any region. However, in 2024, more than 66% of respondents in nearly every region report that their organizations are using AI in their business activities.

Additionally, companies are now using AI in more areas of their business. 50% of respondents report that their organizations have adopted AI in two or more business functions, up from less than 33% of respondents in 2023.

There are also exciting new products and models getting launched. GPT-4 has demonstrated remarkable capabilities, including advanced reasoning, problem-solving, and creative writing. It can process and generate text, code, and images.There is growing promise that GenAI is nearing Artificial General Intelligence (AGI)—machines with human-like intelligence capable of learning any intellectual task— and GPT-4 is considered the closest to achieving this. Additionally, new open-source image models like Flux and Stable Diffusion XL can create highly detailed and realistic images, even from complex prompts.

Anthropic’s CEO believes that AGI will be achieved by 2026. Elon Musk shares a similar outlook, stating that AI will surpass human intelligence by the same time. Mark Zuckerberg has also said that “Even if progress on the foundation models stopped now, which I don’t think it will, I think we’d have five years of product innovation for the industry to figure out how to most effectively use all the advancements that have been built so far“.

There are many visible signs of progress in this transformation, with various products already seeing high adoption and product-market fit. Meta’s open-source Llama models have been downloaded 350 million times to date, 10x the downloads compared to August 2024. Monthly usage (token volume) of Llama grew 10x from January to July 2024. Co-Pilot, driven by GenAI, is the fastest-growing product for GitHub, reportedly accounting for 40% of its growth and generating hundreds of millions in revenue, despite being released only in October 2021. Many companies are scaling revenues or reducing costs using GenAI products. Photoroom, for example, reached USD 65M in ARR in March 2024, a 195% increase year-over-year. The company leverages GenAI to create images for e-commerce businesses, despite some critics suggesting that GenAI is unnecessary for serious applications. Klarna is also making significant strides with AI- 66% of its customer queries are now handled by AI, which is equivalent to the work of 700 full-time agents, resulting in ~USD 40 million in cost savings. In marketing, Klarna uses AI for tasks such as image creation and translation, leading to 37% cost savings, or roughly USD 10 million per year!

There is significant investment aimed at boosting AI capabilities and infrastructure. Tech giants such as Google, Microsoft, and others are spending over USD 50 billion each quarter on digital infrastructure, including graphics processing units for AI, with no near-term moderation expected.

With all this activity taking place, do you believe the AI “train” is slowing down or losing momentum?

However, it is not all rosy!

OpenAI recently faced controversy marked by the sudden departures and rapid rehirings of key personnel, including CEO Sam Altman, Chief Scientist Ilya Sutskever and Senior Researcher Jan Leike. Disagreements over the company’s direction, particularly regarding AI safety, ethical data use (such as the use of copyrighted and sensitive data to train models , and concerns that commercial interests might be prioritizes over ethical considerations, have sparked both internal and public debates.

To address concerns around ethical AI practices, companies have begun forming official licensing agreements and partnerships with data platforms. For example, Reddit has entered into a licensing agreement with Google to provide access to its user-generated content for AI training purposes. Similarly, Shutterstock has partnered with several major tech companies, including Meta, OpenAI, Amazon, and Apple, to license its extensive library of images and videos for AI training. Additionally, Reuters has licensed its news content to AI companies to assist in training their models.

However, there remains a lingering concern that AI models may be biased and discriminatory, depending on the data they are trained on. As Andrew Ng, a pioneer in the AI field, says: “AI is only as unbiased as the data it’s trained on. If we feed it biased data, we’ll get biased results.” The EU AI Act and similar regulations, while aiming to ensure the ethical development and use of AI, face challenges in balancing innovation with control. On one hand, they promote transparency, accountability, and risk mitigation, helping to build trust in AI technologies. On the other hand, these regulations could stifle innovation, particularly in areas where clear-cut rules are hard to define, and may impose significant compliance burdens on businesses, especially smaller ones.

In addition to these concerns, there are significant technical challenges associated with AI. While heavy investments are being made in AI infrastructure, maintaining the computational power required for these systems consumes substantial energy. For instance, training a model like GPT-3 uses approximately 1,300 MWh of electricity, enough to power 130 U.S. homes for a year. A single ChatGPT query consumes 2.9 watt-hours, which is notably higher than the 0.3 watt-hours used by a Google search. If ChatGPT were to handle all 9 billion daily Google searches, annual electricity demand would increase by 10 terawatt-hours, equivalent to the total annual electricity consumption of 1.5 million EU residents. The IEA estimates that energy demand for AI and related technologies could double by 2026, reaching levels comparable to Japan’s total annual electricity consumption. ATo further AI models, will also require larger GPU farms, more advanced models, and increasingly vast amounts of data to process.

Why now is the best time to build?

Around 75% of global CEOs view AI leadership as essential to maintain a competitive advantage. In fact, about 64% of CEOs are willing to take greater risks than their competitors to avoid falling behind. While tech giants are obviously leading the way, business leaders in non-tech sector have also emphasized the importance of integrating AI into the workplace.

Andrew Witty, former CEO of GlaxoSmithKline, said: “AI has the potential to revolutionize healthcare, from drug discovery to personalized medicine. It can help us accelerate the development of new treatments and improve patient outcomes.”

Doug McMillon, CEO of Walmart, said: “AI is transforming the retail industry. It’s helping us to optimize our supply chain, personalize the shopping experience, and improve customer service.”

Mary Barra, CEO of General Motors, said: “AI is a key driver of innovation in the automotive industry. It’s enabling us to develop self-driving cars, improve vehicle safety, and enhance the overall driving experience.”

There are so many such examples across various sectors, reflecting the excitement and opportunity that GenAI has sparked among leaders. Innovation in the space is thriving- new models are continuously being developed and launched, such as Meta’s LLaMA and Mistral. In addition, companies are emerging not only to create these models but also to deploy and offer services built around them. Examples like Photoroom, Greenlite, and Permitflow are just a few of these ventures. By 2015, Google alone had over 2,700 active AI projects.

There is a significant first-mover advantage and compounding benefits to integrating AI into your business processes. AI can greatly enhance decision-making, according to a Gartner survey, businesses adopting AI experienced a 37% reduction in decision-making errors. It can also improve operational efficiency; research from Accenture suggests AI has the potential to boost employee productivity by up to 40%, and companies like Klara are already saving ~USD 50 million annually through AI. Moreover, AI can transform customer experience. According to McKinsey and WEF analysis, GenAI is expected to contribute between USD 2.6 trillion and USD 4.4 trillion to the global economy annually by 2040. This represents a substantial opportunity, and it’s crucial for businesses to position themselves to capture a share of this emerging value.

How is Artefact helping clients adopt GenAI?

Artefact, a global leader in data and AI consulting, is at the forefront of helping clients adopt generative AI technologies. With a team of over 1,800 dedicated data and AI professionals, Artefact provides comprehensive services that include strategy formulation, solution implementation, and the development of PoCs to deliver tangible business value. We have supported over 150 clients in developing and scaling GenAI solutions to deliver measurable business impact.

Conclusion

In conclusion, generative AI is poised to be transformative, much like the internet was decades ago. Despite skepticism and challenges—ranging from ethical concerns to energy demands—its adoption across industries continues to accelerate at an unprecedented pace, driven by tangible business benefits and ongoing innovation. As companies integrate GenAI into their processes, they are seeing significant improvements in efficiency, decision-making, and customer experience. With an anticipated multi-trillion-dollar impact on the global economy, this technology offers a powerful competitive advantage. The best time to leverage GenAI is now, as its rapid advancement aligns with increasing business demands and the need for innovative solutions.

BLOG

BLOG