NEWS / DATA MARKETING

29 April 2020

COVID-19 has had a huge impact on the media industry. Guillaume Balloy, Managing Director at Artefact France, assesses the cost implications on social ads, paid search and programmatic advertising.

The COVID-19 crisis has had a huge impact on the media industry. TV, OOH, Radio and Print publishers are currently working hard to protect their businesses using various strategies, including adapted commercial offers. As an example, we observe that in France some traditional media pricing may have dropped by up to 50% depending on circumstances.

What about digital media costs?

Beyond some publishers’ very attractive deals, akin to those in traditional media, a large part of digital media costs is related to bids and real-time competition. This has a double effect on prices: digital media consumption is growing and creating more available inventory; while media buying competition is decreasing.

We will focus here on social ads, paid search and programmatic advertising to analyse what it implies for media costs.

I. Social advertising media costs

Based on Artefact EMEA campaigns from January 6th to April 20th.

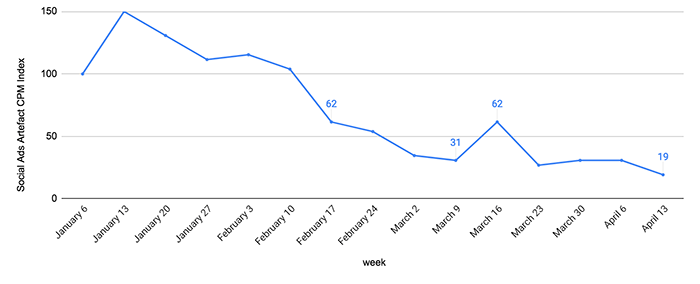

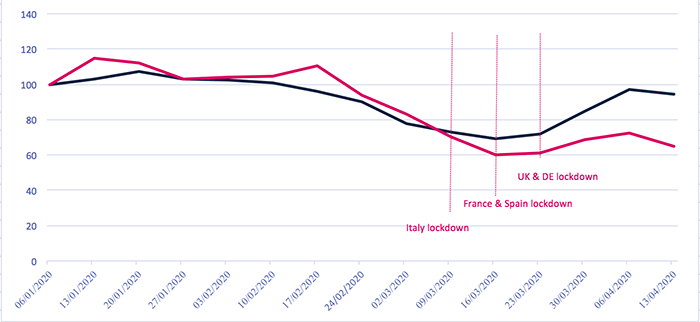

In April, the average social advertising CPM of EMEA Artefact campaigns (CPM = Cost Per Mille, Cost for One Thousand Impressions) – across all advertisers, platforms, formats or strategies we applied – dropped down to only 40% of the average Q1 CPM . Even as a decrease in prices comes to no surprise , the scale of this fall is quite impressive.

Social Ads CPM Index

Artefact EMEA Campaigns

index 100 = average CPM during the first complete week of January

Source: Artefact EMEA social ads campaigns

Time spent on social platforms is soaring: Another consequence of COVID-19

Looking at the case of Italy during the first weeks of lockdown, we see that time spent on Instagram and Facebook was already up by 70% compared to the previous year, with figures likely to keep on rising. Globally, TikTok says that the average number of videos viewed each day increased by 84% between the first week of January and the last week of March.

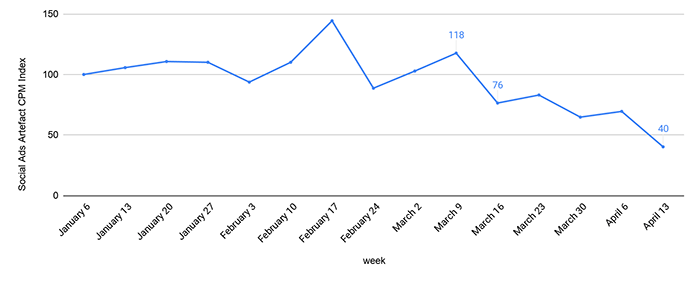

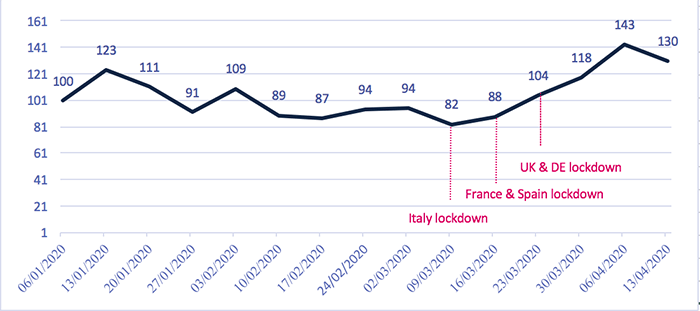

Such a massive rise in media consumption, combined with a CPM drop, has an impressive impact on campaign engagement costs. In the end, the average cost per engagement of our social advertising campaigns in EMEA has been divided by five between January and April on social networks.

Social Ads Engagement Cost Index

Artefact EMEA Campaigns

index 100 = average engagement cost during the first complete week of January

Engagement: likes, shares, followers

Source: Artefact EMEA social ads campaigns

II. Programmatic advertising media costs

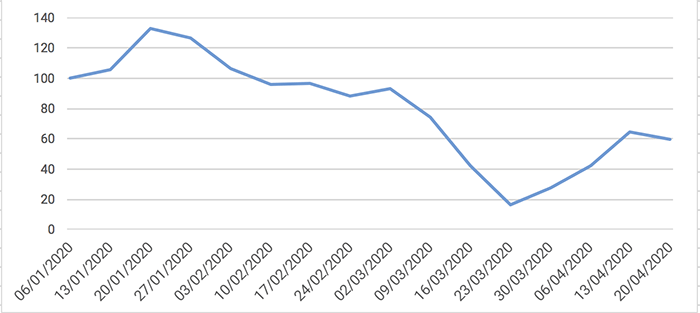

Programmatic buying is certainly the purest form of media bidding. While implements such as floor price and 1st price auction can lower the impact of current circumstances, the drop in demand has clearly shaken CPMs.

Standard IAB Formats

300X250 / 300X600 CPM Index

index 100 = average CPM for these IAB formats during the first complete week of January

Source: Artefact EMEA programmatic campaigns

Classic IAB formats CPM dropping from the end of January onwards is understandable: loss of active advertisers lowers CPMs across all channels. Yet one sees a rise starting in the last week of March. This may seem rather surprising: the crisis is not over yet, and advertisers’ spending levels are still below usual figures.

In fact, that makes sense, when you think about the probable global blacklisting of content related to COVID-19. A scissors effect is again at play:

- effectively a lot more people are online, meaning more potential ads;

- yet a very large part of this online content is COVID-related and excluded as such from a lot of strategies, following a brand protection & safety objective. This slightly participates in the increase of CPMs.

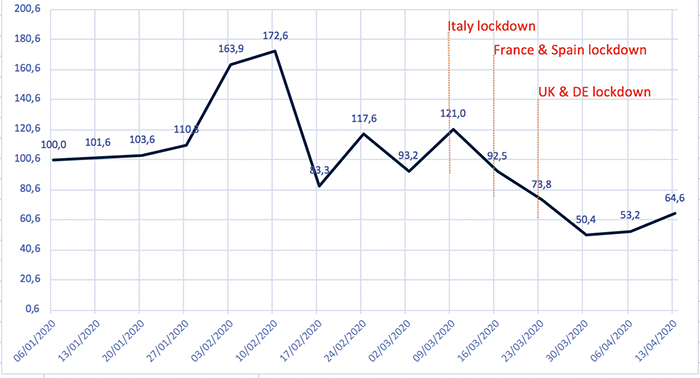

Video CPMs are also affected by the situation: advertisers can today buy video impressions for almost half the price of Q1 CPMs. Video and more generally branding campaigns should be more impacted in volume than performance campaigns. This is because the priority is definitely on the lower funnel strategies today, also since branding messages cannot remain the same in the current context.

Some brands keep the same communication plan, and really don’t want to change anything, for fear of being accused of adopting opportunistic stances. Still a lot of them choose to embrace the topic really explicitly. As doing this implies time to adapt, we can imagine a more active branding activity in the coming weeks.

Instream Video Formats

CPM Index

index 100 = average CPM for video formats during the first complete week of January

Source: Artefact EMEA programmatic campaigns

III. Paid search media costs

This is the most complicated marketing channel to analyse in terms of media costs, as these costs are related to a wide spectrum of criteria.

Advertiser business sector, performance history of the advertiser’s website, search bidder objectives on specific campaigns, and last but not least unfathomable search engines algorithms: all will impact paid search media costs. To understand this we analysed our paid search campaigns running in EMEA.

Globally if we just take paid search campaigns figures, it looks like we have a slight decrease of CPCs (Cost Per Click) for both generic and brand campaigns.

On one side, brand keywords CPCs stay pretty low: this is explained by the fact that brands all over have less competition regarding their own brand keywords. Which means that getting market shares from competitors’ brand keywords is not an immediate top priority.

On the other side, generic keywords CPCs are already getting back to their initial level: generic campaigns remain the real battlefields of performance. At least for activity sectors benefiting from a boost in leads and ecommerce sales, and which have not been frozen like the travel industry has.

Global Paid Search Cost Per Click Index – Out of Shopping and App Campaigns

Artefact EMEA Campaigns

Brand Keywords – Generic Keywords

index 100 generic keywords = average generic CPC during the first complete week of January

index 100 brand keywords = average brand CPC during the first complete week of January

Source: Artefact EMEA paid search campaigns

Retailers’ paid search advertising: a close-up

E-commerce has been booming since the start of COVID-19 lockdowns. The last Kantar survey (April 8th 2020) on e-commerce behaviours indicates that the share of consumers making more than half of their purchases online increased by 25% to 80%, depending on countries.

So CPC in paid search for retail brands hasn’t dropped at all but remained quite stable on brand and generic keywords. Even more, we see a significant rise in shopping campaigns CPC in EMEA since the beginning of the Italian lockdown.

Retailers Shopping Campaigns CPC Index

Artefact EMEA Campaigns

index 100 = average CPC during the first complete week of January

Source: Artefact EMEA shopping campaigns

IV. What now?

The most interesting lessons are about how to invest our marketing budgets wisely.

Fluctuating performance marketing is the real challenge

Brands need to change the way they sort priorities in terms of digital marketing indicators and have to do it fast. What is a success indicator in this unprecedented situation? Each brand has to determine which proxy would be the best contributor to their future performance.

Performance goals: refocus on relationships

Brands, at least those without immediate strong e-commerce business and delivery capacities, may want to revise the weight of their mid/long-term versus short-time objectives if they are not doing it already. And long-term marketing might not only imply 30 seconds inspirational videos…

Long-term marketing can also mean lead generation, CRM or social CRM. Lead generation campaigns, with relevant content, will build the basis of performance on future post-COVID business. But to be efficient, these campaigns should answer people’s actual concerns: stocks, delivery, reopening, the brand’s workers’ safety, COVID-19 tips, and many other topics (directly COVID-related or not).

As a matter of fact, the performance of social engagement campaigns, as seen above, indicates we are in a good moment to build relationships with audiences. People are more attentive and sensitive to brand messages than ever (again, with the right content).

Each brand has to find the right content in order to offer value against a registration, a like, a follow or any other engagement. And that will :

- maintain top-of-mind awareness with a really core target;

- accumulate a basis of prospects already engaged;

- enhance interest around store openings to come, etc…

Answering audience concerns: adapted content strategy

Surprisingly, one can still have to really dig into a retailer’s website to find anything about delivery, store opening hours (for those that can open), or measures taken to participate in the global effort to restrain the pandemic. Most of the time, content is available…but hidden somewhere within the website and not enough prioritised from an SEO perspective.

Yet pushing content and SEO as priorities makes a lot of sense, knowing that brands will have to do more with less (less media investment to come) and that all these new topics will keep being on the vast majority of minds for the next few months.

Saving short-terms investments through a long-term strategy is a typical SEO/content brief, isn’t it ?

“More with Less” era for marketers: data on an ever more strategic level

Pending questions in brands organisations will become top priorities in future months:

- Does my technical stack allow me to reap the best of my 1st party data?

- How to scientifically limit acquisition budgets to only reach people with the highest potential of becoming clients?

- How much budget can I save from synergies between SEO and paid search?

- What is the real incremental impact of my marketing actions?

Many other structuring questions will soon come to the fore, and will have to be dealt with quickly…

BLOG

BLOG