Despite data mesh fast becoming a buzzword in the financial services industry, it remains shrouded in mystery. Organisations want to embrace it, but few have a holistic understanding of what it is. Even fewer realise that the component parts of a data mesh are not brand new concepts, meaning many financial institutions will already have some base constituents in place. But adopting and embedding data mesh principles effectively across an organisation relies on a robust understanding of business data challenges and how different aspects of data mesh address these to achieve tangible business impact.

Three Fundamental Data Challenges for Financial Services

Through our experience of working with large global financial institutions, we have observed three fundamental data challenges. These remain endemic and common across financial services organisations, whether that’s banks, insurance providers or asset managers.

Data Mesh: What It Is and How It Can Add Value

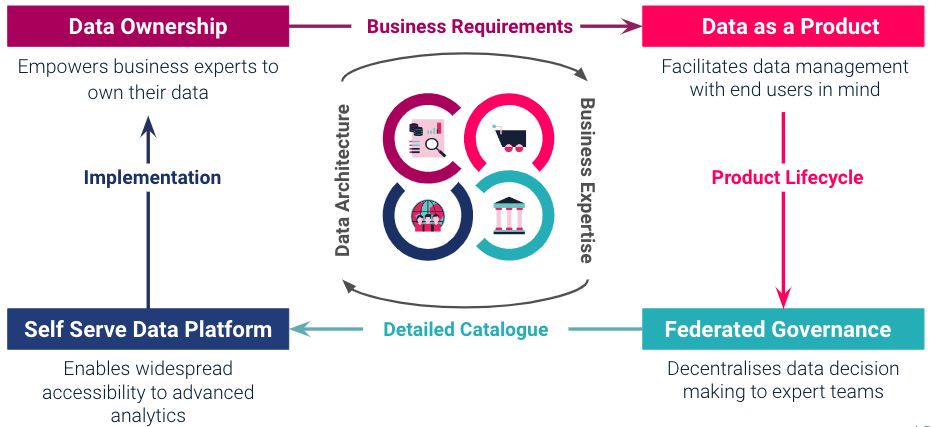

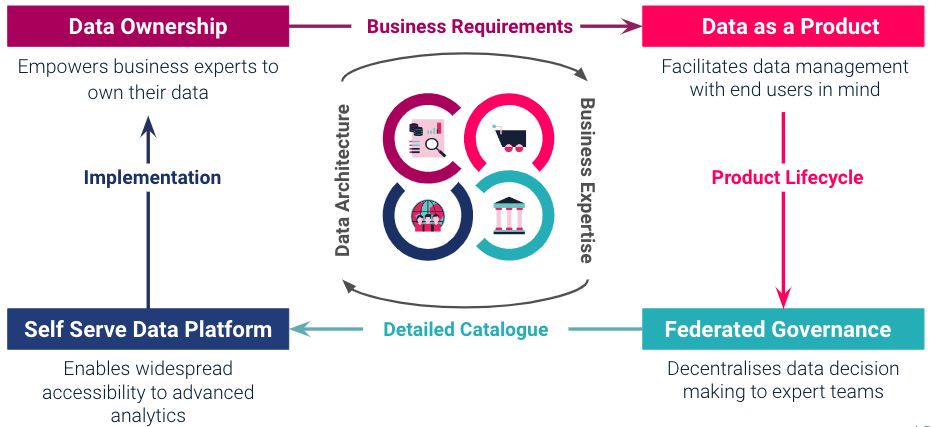

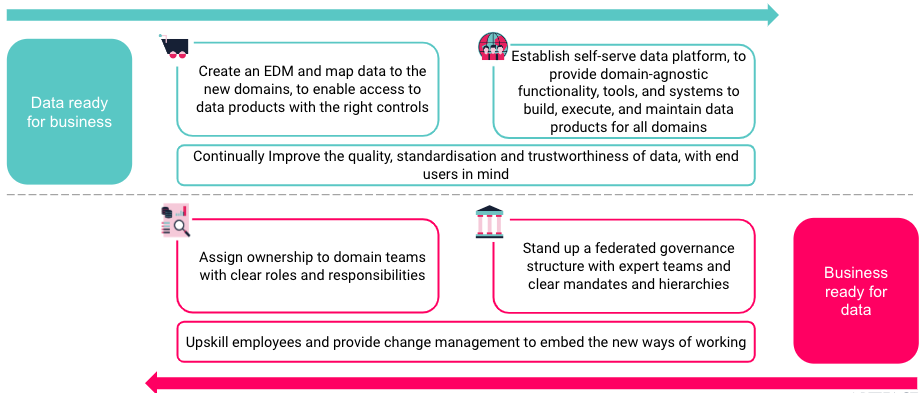

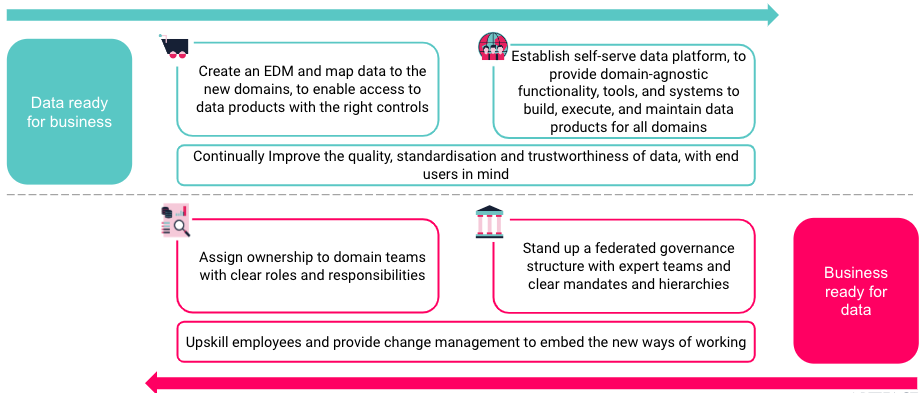

Data mesh is a data management framework that allows the enterprise to own the data it creates and make it available to consumers across the business while ensuring the right controls and agreements are in place so that this data remains in the right hands. Data mesh comprises four key elements: data ownership; treating data as a product; establishing a self-serve data platform; and implementing federated governance. Implementing these components means data can be used responsibly across data domains and enables decentralised data decision-making.

Each pillar of the data mesh comes together to comprehensively manage and solve the most common data issues facing financial services companies, all of which inhibit digital transformation.

Self Serve Data Platform

A self-serve data platform is often the basic foundation required to enable democratisation and overcome the challenges of legacy architecture. A cloud powered data platform enables targeted access to data, whilst maintaining transparent compliance controls, and provides the flexible, scalable architecture that is needed to develop data applications and data products. (Artefact has a proven track record for delivering data platforms rapidly, with a clear eye on business value, usability and information security.)

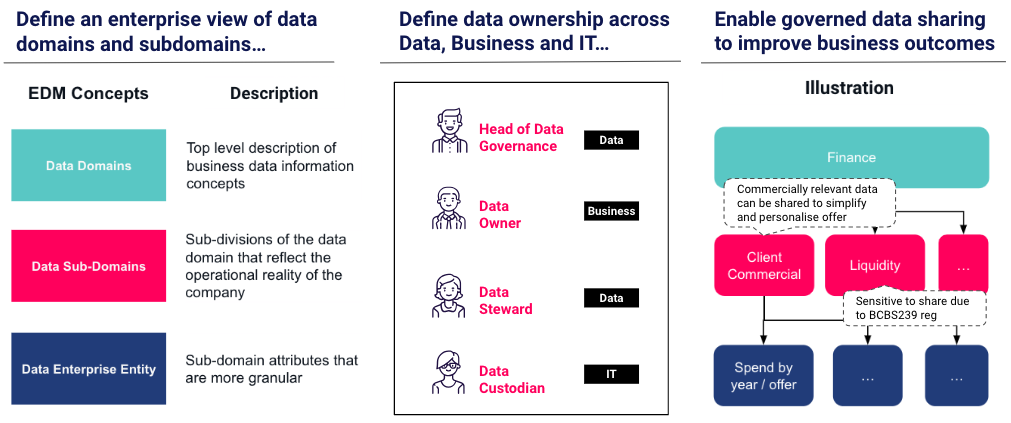

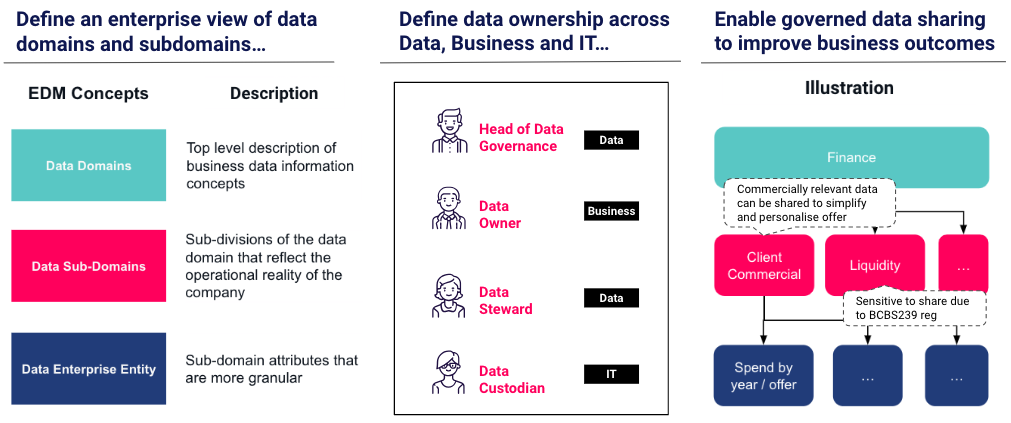

Data ownership

Defining data ownership across data, business and IT is essential because it enables governed data sharing and improved business outcomes. Additionally, adopting an enterprise-wide view of data domains and subdomains helps to prevent bottlenecks and ensures alignment with evolving business needs. An Enterprise Data Model (EDM), which breaks down silos and establishes clear data ownership and understanding, is therefore the next important step in laying the foundations for business data ownership.

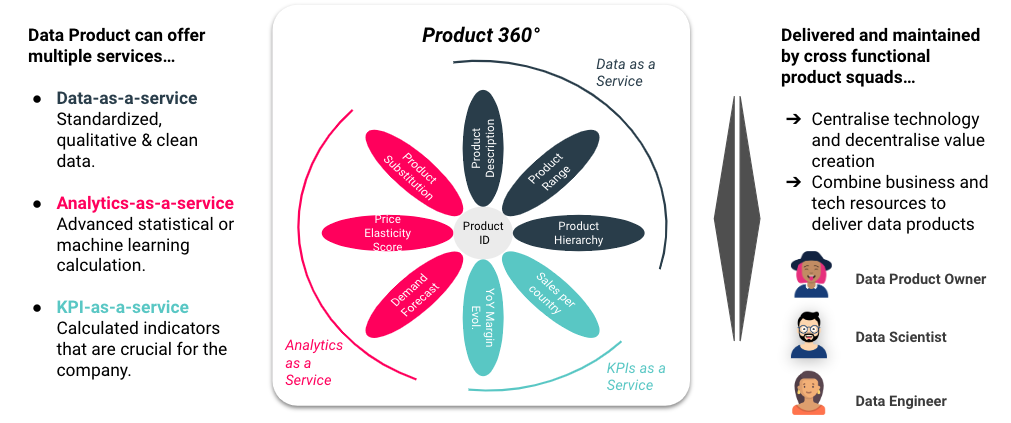

Data as a product

A data product oriented approach makes data transformation tangible for business users, ensures a clear path to value and enables greater democratisation of data. Data products can be thought of as packaged services offered to ‘internal customers’: data-as-a-service provides standardised and clean data; analytics-as-a-service offers advanced statistical or machine learning calculations; and KPI-as-a-service delivers crucial business performance indicators. These data products are maintained by cross-functional product squads that combine business and technical resources to meet organisational needs.

Federated governance

Data transformation needs to be underpinned by an operating model and governance structure that enables an appropriate amount of decentralisation whilst maintaining security and compliance requirements. Although the ‘right’ operating structure will vary depending on the financial services company in question, all organisations need to transition from centralisation to controlled democratisation, a change that needs to be business, rather than IT, led.

Considerations and Conclusions

Adopting a data mesh approach in the financial services sector requires several significant shifts – from legacy systems to scalable cloud infrastructure, centralised data management to controlled data democratisation, and IT-led data to business-led data. All of these necessitate both technical and organisational changes, which can pose challenges to any organisation.

However, adopting a well-implemented data mesh approach that encompasses the changes required can empower financial service companies to leverage their data effectively by breaking down silos and making data-driven decisions that drive business growth and innovation. And in doing so they help to transform themselves into future-facing organisations.

BLOG

BLOG