The financial services industry is at a pivotal moment, where AI is no longer just an enabler but a key driver of competitive advantage. From automating routine processes to transforming decision-making, AI is reshaping financial institutions at an unprecedented scale.

At CDAO 2025, Artefact presented its vision for Scaling AI in Financial Services, focusing on three critical dimensions:

- The value of AI in financial services and the new frontier of agentic AI

- AI governance as a fundamental pillar to mitigate risks and ensure trust

- The agentic paradigm, where AI moves beyond automation to autonomous orchestration

AI is no longer a futuristic innovation, it’s the core engine of financial transformation. Institutions that embrace structured AI deployment, governed risk frameworks, and intelligent automation will lead the next era of financial services.

From automation to Agentic AI: The next frontier

AI automation is not new to financial services. Institutions have long relied on Robotic Process Automation (RPA) to streamline back-office functions, enhance compliance, and improve efficiency.

However, the industry is now entering a new phase, the Agentic AI era, where AI systems move beyond rule-based automation and evolve into intelligent, adaptable, and autonomous agents.

What are AI Agents? And why do they matter ?

AI Agents are next-generation AI systems capable of reasoning, decision-making, and executing tasks across multiple functions. Unlike traditional automation tools, AI agents combine predictive analytics, cognitive reasoning, and autonomous execution to optimize business processes.

Example: An AI-powered underwriting agent can analyze historical risk data, client profiles, and market trends to generate personalized loan decisions in real time, enhancing both efficiency and customer experience.

Why are AI Agents essential for Financial institutions ?

FS institutions are dealing with increasing complexity in:

- Data Chaos: Managing structured and unstructured data at scale

- Need for Speed: Rapid decision-making in real-time financial environments

- Competitive Pressure: The rise of AI-driven fintech challengers

Three levels of AI agents in Financial Services

We see three main categories of AI agents, each offering varying levels of autonomy:

- Task agents (Assistants): AI-powered assistants that automate single tasks by breaking them into logical steps. Example: AI-driven customer support chatbots.

- Workflow agents: These execute predefined sequences with environmental awareness, improving efficiency and compliance. Example: Automated loan processing agents.

- Autonomous agents: These AI systems operate with minimal human intervention, making decisions based on real-time data. Example: AI-managed investment portfolios.

Governance & the AI risk imperative

AI in financial services presents immense opportunities, but also significant risks. Institutions that fail to implement robust AI governance expose themselves to regulatory penalties, reputational damage, and operational failures.

In 2023, financial institutions faced over $200 million in regulatory fines due to inadequate AI governance. 77% of financial services firms reported a lack of AI governance frameworks as a major challenge.

Key AI risks in Finance:

- Bias & fairness: Ensuring AI does not reinforce existing biases in lending, risk assessment, and customer interactions.

- Explainability & transparency: Regulatory bodies demand that AI-driven decisions be interpretable.

- Security & data privacy: Protecting sensitive financial data from AI vulnerabilities.

- AI hallucination risk: Avoiding the generation of misleading or incorrect financial information.

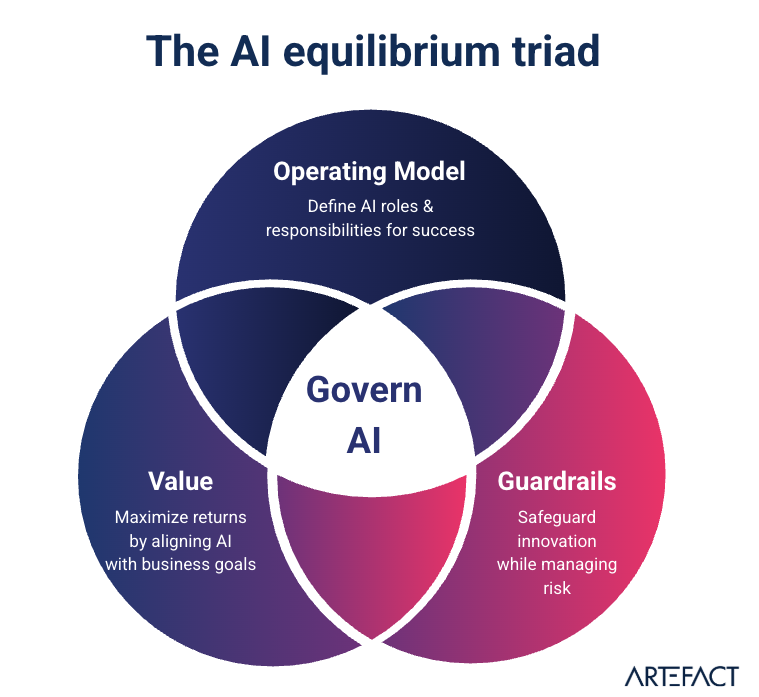

The AI equilibrium: Balancing innovation & governance

At Artefact, we define a structured approach to AI governance through the AI Equilibrium Triad:

- Value: Align AI strategies with business goals to drive impact

- Guardrails:Implement ethical and regulatory safeguards

- Operating Model: Define clear roles and responsibilities for AI oversight

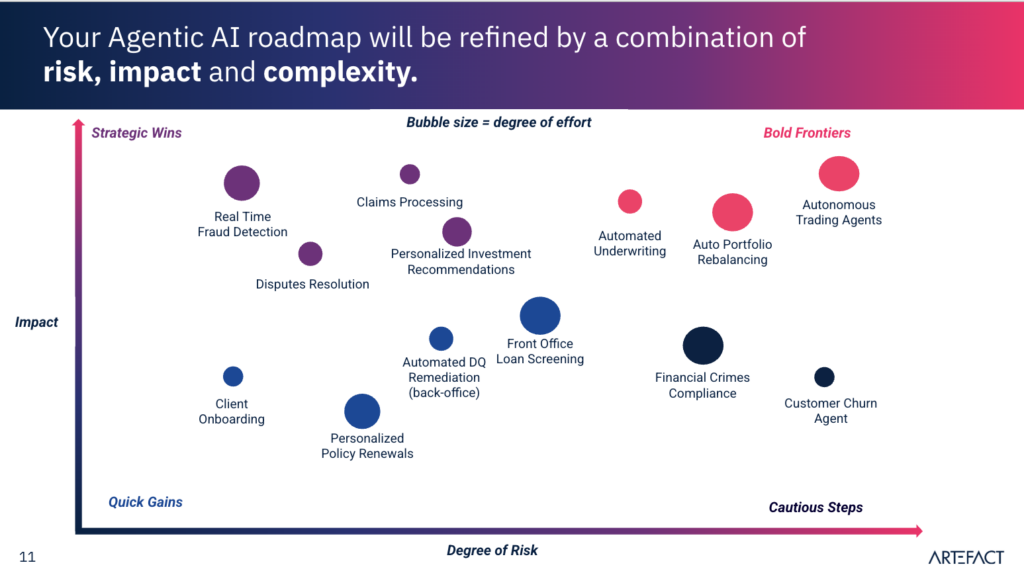

Scaling AI: A roadmap for financial institutions

To industrialize AI at scale, financial institutions must balance value, risk, and feasibility. The path forward involves:

- Prioritizing AI use cases that maximize both business impact and scalability

- Building an operating model and defining the roles and responsibilities to drive success.

- Implementing continuous risk controls to safeguard AI deployments

Example: A global banking institution leveraged AI agents to automate customer onboarding, reducing processing time by 40% while ensuring compliance with stringent regulatory frameworks.

The Road ahead: responsible AI for financial services

AI is no longer just an enabler, it’s a necessity. However, financial institutions must embrace a structured approach to maximize AI’s potential while managing risk effectively.

> AI Agents will redefine financial workflows, making them more adaptive, autonomous, and intelligent.

> Governance will be the differentiator, ensuring AI remains ethical, transparent, and compliant.

> Institutions that scale AI responsibly will lead the next era of financial services.

At Artefact, we help financial institutions accelerate AI adoption, balancing value, scalability, and governance.

Want to explore how AI agents can drive efficiency, compliance, and innovation in your organization?

BLOG

BLOG